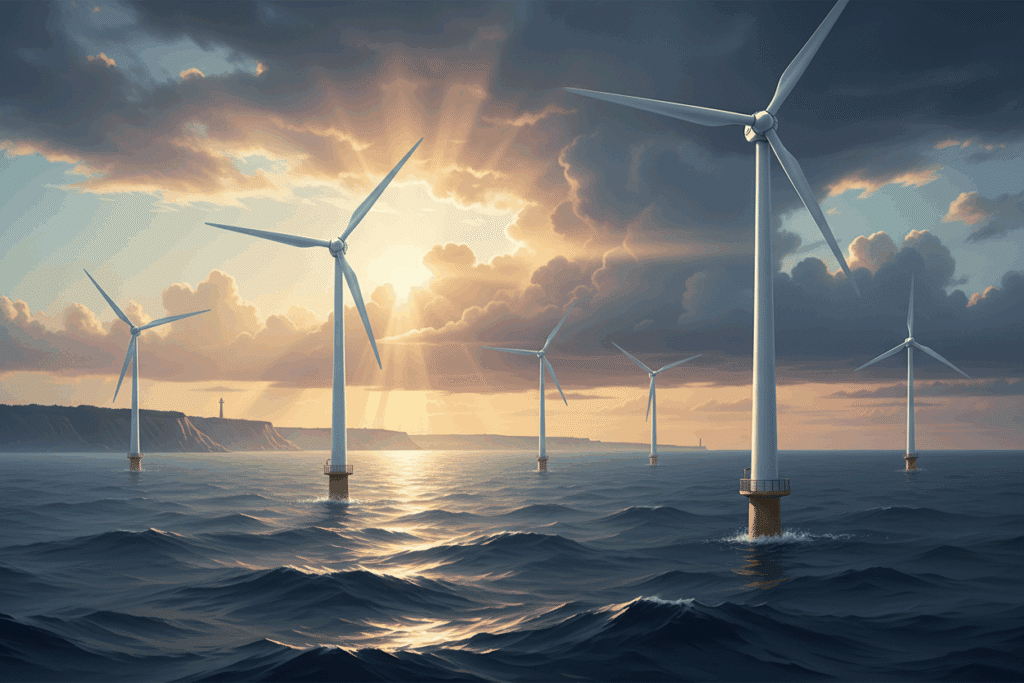

A Historic Milestone for Polish Energy Transition

Poland has achieved a historic milestone by awarding 3.4 GW of offshore wind capacity in its first-ever tender. This allocation marks the concrete beginning of offshore wind development in the Baltic Sea for a country historically dependent on coal. The winning projects represent an investment of several billion euros and position Poland as a major emerging market for offshore energy in Eastern Europe. This momentum is part of the country’s energy strategy aimed at reaching 18 GW of offshore wind by 2040.

Key Facts

What? The Polish government has awarded 3.4 GW of offshore wind capacity in its first national tender, a key milestone for the country.

When? The allocation was announced on December 18, 2025.

Where? In the Baltic Sea, off the Polish coast, a strategic zone for renewable energy development in Northern Europe.

Who? The projects were awarded to consortia including Polenergia-Equinor, RWE, and other international developers.

The Polish government is leading this strategic energy transition.

Analysis: Why This Matters

A New Emerging Market

Poland officially joins the club of countries developing offshore wind in the Baltic Sea, alongside Germany, Denmark, and Sweden. With a target of 18 GW by 2040, the Polish market represents massive opportunities for the offshore supply chain.

Accelerated Decarbonization

Historically heavily dependent on coal, Poland is accelerating its energy transition to comply with European climate and energy objectives. Offshore wind is becoming a pillar of this strategy.

Massive Investments

These 3.4 GW represent estimated investments of €6-8 billion, creating thousands of jobs in construction, installation, and operation.

Baltic Sea Boom

The Baltic Sea is becoming a priority zone for European offshore wind, with multiple projects underway off Poland, Germany, and the Baltic states.

Industry Impact

Supply Chain Opportunities

- Turbine manufacturers (Vestas, Siemens Gamesa, GE)

- Cable manufacturers

- Foundation suppliers

- Installation vessel operators

Port Development

Grid & Transmission

- Strengthening of grid infrastructure to integrate these gigawatts into Poland’s energy mix

Risks

- Maritime spatial planning challenges due to military presence, shipping routes, and fishing activities in the region

Implications for Maritime Operations

Opportunities

- New massive market for tracking and monitoring offshore activities in the Baltic Sea

- AIS solutions for construction and operation zone surveillance

- Maritime visibility needs for port logistics optimization (Gdansk, Gdynia)

Risks

- Increased competition in this emerging market

- Maritime planning complexity with heightened military presence in the Baltic

- Geopolitical risks in Eastern Europe

Recommended Actions

- Prospect Polish developers (Polenergia, Equinor)

- Adapt solutions for the Polish market (tracking, environmental monitoring, fleet optimization)

- Participate in offshore events in Poland and the Baltic region (WindEurope, Baltic Offshore, etc.)