Imagine the world’s great ports where thousands of ships dock daily, moving millions of containers across continents. These maritime hubs serve as the backbone of global trade, handling vast cargo volumes that fuel economies and industries. With shifting routes, technological advancements, and economic policies, port rankings evolve yearly, reflecting their growing importance in international logistics. Through this article, we’ll explore the busiest maritime hubs, their significance, key factors, and emerging trends in world trade.

Latest Ranking of the World's Top Ports

The Industrial Revolution in the 19th century introduced steamships, rail connections, and mechanized cargo handling, leading to modern deep-water ports. Today, technological advancements such as automation, smart logistics, and sustainable infrastructure continue to shape the future of global port operations.

Top 4 Ports by Cargo Volume

The world’s largest ports handle billions of tons of cargo each year, driving international commerce and economic growth. Which harbors lead the way in sheer volume, managing massive shipments of raw materials, containers, and bulk goods?

Shanghai Port (China)

Handling over 47 million twenty-foot equivalent units (TEUs) and more than 800 million tons of load annually, Shanghai Port stands as the world’s busiest and most significant maritime hub. Located at the mouth of the Yangtze River, it serves as a gateway for China’s industrial exports, linking major worldwide markets. The port boasts innovative automated terminals, including the Yangshan Deep-Water Port, ensuring high efficiency and rapid cargo movement.

Singapore Port (Singapore)

For decades, Singapore Port has ranked among the largest and busiest transshipment hubs, handling over 37 million TEUs annually. Serving as a key maritime gateway, it manages immense traffic, connecting 200 shipping lines to over 600 ports. Consistently topping the list of harbors, Singapore remains vital for worldwide commerce, strategically positioned at the crossroads of major shipping routes in Southeast Asia.

Ningbo-Zhoushan Port (China)

Ningbo-Zhoushan Port, a key freight hub in Asia, is renowned for its massive throughput and strategic location in East China. Spanning 220 kilometers of coastline, it comprises 19 port areas and features over 200 deepwater berths for vessels exceeding 10,000 DWT (Deadweight Tonnage), including 115 berths for ships over 50,000 DWT. As one of the busiest ports, it efficiently handled billions of tons of supplies, connecting China with the United States and beyond.

Port of Rotterdam (Netherlands)

When it comes to maritime logistics, the Port of Rotterdam remains Europe’s largest port, processing around 400 million tons of load annually. As a major terminal for energy, containers, and bulk goods, it generates €30.6 billion for the Dutch economy and provides 193,000 jobs in the Rotterdam-Rijnmond region. Compared to other European ports, its modern infrastructure ensures efficiency and growth.

Notable Rising Harbors and Emerging Trade Hubs

In 2023, worldwide container throughput increased by 3.2%, with several terminals recording double-digit growth in traffic and capacity. These rising trade hubs are transforming regional economies, improving logistics efficiency, and positioning themselves as key players in international shipping. The following are fast-growing ports and expanding commerce hubs transforming regional and intercontinental shipping.

Port of Brunswick (USA):

The U.S. is primarily known for the Port of Los Angeles, the largest port in the country, processing over 9.2 million TEUs in 2023. However, in 2024, the Port of Brunswick became the largest U.S. automobile port, surpassing Baltimore. Located in Georgia, in the south of the U.S., it experienced over a 13% increase in vehicle movement, managing 841,000 units. Unlike terminals with bustling cityscapes, Brunswick’s proximity to Georgia’s beach regions offers a unique blend of industry and coastal accessibility.

Shandong Port Group (China):

In 2023, Shandong’s terminals collectively achieved a load throughput of 1.71 billion tons, a 5.6% year-on-year increase, making it the world’s busiest cargo-handling port. The port cluster, led by Qingdao Port, also saw a 10.8% rise in container volume, reaching 41.32 million TEUs and surpassing Singapore.

Dubai Ports’ Prospective Mexican Port

Dubai-based DP World is in discussions to establish operations in Mexico, aiming to create a significant port that facilitates supplies’ movement into the U.S. This initiative reflects a strategic shift to overcome previous expansion challenges in the U.S. market and capitalize on increasing demand in Mexican ports due to geopolitical shifts and manufacturing trends.

Key Factors Influencing Port Rankings and Performance

In Europe, maritime trade dates to ancient Greece and Rome, flourished in medieval hubs like Venice and Antwerp, and expanded during the Industrial Revolution, shaping modern commerce. As demand for faster and more sustainable transport grows, ports must continuously adapt to remain competitive.

Geographical Location and Strategic Importance

Port performance is shaped by efficiency, effectiveness, and resilience, which together determine its ability to adapt and operate smoothly. These factors influence a port’s capacity to manage cargo flow, minimize delays, and maintain stability amid disruptions.

Geographical location plays a crucial role in a port’s growth and competitiveness, particularly when situated near major routes. Ports like Los Angeles, positioned along key Pacific shipping lanes, facilitate extensive container movement, processing millions of TEUs annually. Strategic locations, such as those near the Strait of Malacca or the Suez Canal, enhance connectivity, attract shipping activity, and strengthen regional economies.

Infrastructure and Technological Advancements

Today, the busiest ports rely on advanced infrastructure to manage growing traffic and container volumes. A smart port is a highly connected and technology-driven facility that utilizes automation, digital systems, and data analytics to improve efficiency, security, and environmental sustainability.

Key innovations include:

Automated container terminals: Ports like Rotterdam use robotic cranes and self-driving vehicles to streamline cargo movement.

Smart tracking systems: Real-time monitoring optimizes container flow and reduces congestion.

Port expansions: Many ports undergo large-scale upgrades to increase capacity and improve traffic flow.

Government Policies and Trade Regulations

Government policies and regulations shape the movement of goods by establishing tariffs, customs procedures, and investment rules. Free trade agreements, such as the USMCA and the EU’s single market policies, reduce barriers and foster economic growth by streamlining cross-border transactions.

Conversely, tariffs and export restrictions, often imposed during disputes, can disrupt supply chains and raise costs. Regulatory frameworks also enforce environmental standards, promoting sustainable logistics and transportation. Strategic investments in infrastructure, like China’s Belt and Road Initiative, which funds projects in over 60 countries, enhance connectivity.

Trends and Comparisons in Shipping and Logistics

The rise of automation, real-time data tracking, and sustainable practices is transforming supply chains, making them more efficient and resilient. Comparing regional trends reveals how different economies adapt to these changes, influencing costs, transit times, and overall connectivity in the movement of goods worldwide.

Comparing Port Sizes, Cargo Volumes, and Container Throughput

Ports vary significantly in size, cargo capacity, and container throughput, shaping global trade efficiency and regional economic growth. Comparing these factors highlights the differences between major shipping hubs, their specialized operations, and their impact on supply chains.

Comparing Transport Hub Sizes

Large-scale hubs, such as those in China and the United States, cover thousands of hectares with dedicated zones for bulk shipments, container storage, and intermodal transfers. For instance, the largest transport hub in the world, located in Shanghai, spans over 3,600 hectares, allowing it to process vast amounts of goods daily. In contrast, smaller hubs in developing regions may be constrained by limited space, restricting their ability to accommodate high traffic volumes and large vessels.

Differences in Volume Capacity

The volume of goods processed varies among major hubs. High-capacity locations in Asia, Europe, and North America manage hundreds of millions of metric tons annually. For example, Singapore moves over 600 million metric tons of products per year, making it one of the most efficient logistics centers in the world. Nonetheless, smaller regional hubs often handle less than 50 million metric tons, leading to fewer connections and slower shipment times.

Variations in Container Throughput

Container throughput, measured in TEU, highlights differences in efficiency and operational scale. Leading hubs like Shanghai and Singapore surpass 40 million TEUs annually, benefiting from advanced automation and deep-water access for ultra-large vessels. The Port of Los Angeles, the busiest in the U.S., manages around 9 million TEUs each year, serving as a key gateway for trans-Pacific shipments. In contrast, smaller hubs handling under 5 million TEUs may experience congestion, longer dwell times, and limited intermodal connectivity.

Recent Trends Impacting Port Traffic

Global trade is constantly evolving, driven by technological advancements, shifting economic policies, and changing consumer demands. To remain efficient, shipping must adapt to trends like supply chain disruptions, e-commerce growth, AI-driven logistics, and emerging trade routes.

Supply Chain Disruptions

Supply chains have faced major challenges due to events like the COVID-19 pandemic, geopolitical conflicts, and extreme weather. In 2021, container rates surged over 400%, causing severe congestion. Labor shortages and cybersecurity threats continue to impact operations, pushing logistics hubs to adopt resilient strategies like nearshoring and regionalized supply networks.

E-Commerce Growth

The rise of online shopping has increased the demand for faster freight movement. By 2023, global e-commerce sales surpassed $5.8 trillion, requiring expanded fulfillment centers and digital tracking systems. Major hubs are enhancing real-time inventory management and automation to meet delivery expectations.

AI-Driven Logistics

Artificial intelligence is optimizing operations by predicting demand surges and improving scheduling. Smart Ports uses AI for vessel monitoring, cutting wait times. Autonomous cranes and robotic warehouses further boost efficiency and reduce costs.

Shifting Trade Routes

New economic alliances and infrastructure projects are altering transport flows. The Arctic route is cutting transit times by up to 40%, while China’s Belt and Road Initiative is reshaping connections between key markets. Companies are diversifying sourcing to navigate shifting regulations and tariffs.

Sinay's Technologies: Optimizing Tracking for Busy Ports

Efficient vessel and container tracking is crucial for smooth port operations and supply chain visibility. Our company delivers advanced tracking solutions, ensuring real-time monitoring, optimized navigation, and seamless data integration for shipping stakeholders.

Enhancing Maritime Operations with Real-Time Vessel Tracking

Our vessel tracking provides real-time ship location visibility for shipping lines, freight forwarders, and port authorities. Using AIS, GPS, and satellite tracking, we optimize navigation, improve fleet performance, and enhance security. Users can track vessels by IMO or MMSI number, ensuring compliance and efficient communication between offshore and onshore teams.

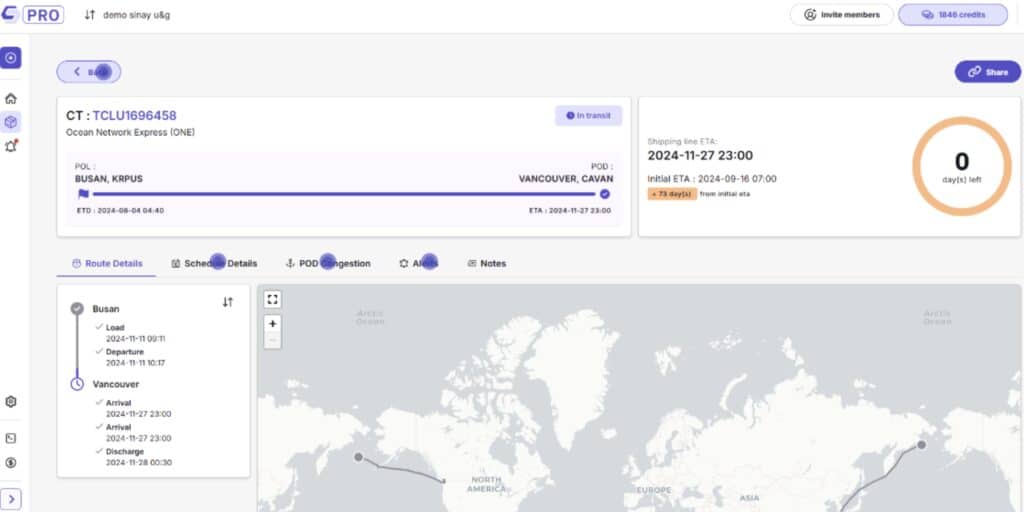

Safecube: Smarter Container Tracking

In addition to vessel tracking, we offer Safecube, a platform that simplifies container tracking and data integration. With access to 180+ carriers, users can track shipments via CT, BL, or BK numbers, build precise container lists, and ensure full transportation visibility without blind spots.

Conclusion

Ports integrate extensive infrastructure, including berths, terminals, cranes, inspection zones, and storage facilities, with seamless connections to efficient transport networks, ensuring smooth distribution. These dynamic hubs attract skilled professionals and businesses in logistics, warehousing, and goods processing. While some specialize in commercial cargo, others support bulk shipments and the fishing industry, reinforcing their essential role in global trade.

FAQ about busiest ports in the world

Shanghai, Singapore, and Ningbo-Zhoushan are the top three busiest ports by container throughput, processing millions of TEUs (twenty-foot equivalent units) each year.

Key factors include strategic location, infrastructure, automation, trade routes, and economic activity. Ports in major manufacturing and trade hubs naturally handle more cargo.

Busiest ports serve as critical gateways for international shipping, influencing supply chain efficiency, freight costs, and global commerce flows.